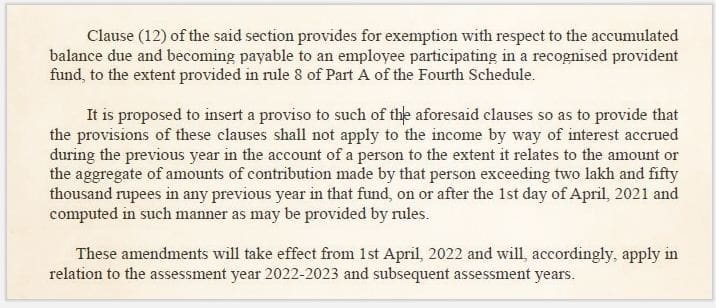

We are all aware that Budget 2021 (The Finance Bill 2021) has introduced one of the key amendments to the EPF Act. As per this amendment, from 1st April 2021 onwards, the interest on any contribution above Rs. 2.5 lakh by an employee to a recognized provident fund is taxable.

Until FY 2020-21, the interest income earned on contributions to EPF made by the employee was completely TAX-FREE.

Related Article : For more details, you may kindly go through this article @ Interest on EPF Contributions above Rs 2.5 lakh is Taxable | Budget 2021

In addition to the above amendment, the central govt has decided to implement the below important changes to the EPF act.

Below are the new EPF rules that EPF members need to be aware of;

Let’s now go through these new EPF rules 2021 in detail….

So, hurry up, link your UAN to Aadhaar and get it verified.

In an another major amendment to the EPF act, the central govt has hiked the insurance claim amount under the EDLI scheme to Rs 7 lakh.

In a gazette notification, the Employees’ Provident Fund Organisation (EPFO) said the minimum death insurance has been increased to Rs 2.5 lakh and the maximum to Rs 7 lakh, from the earlier limits of Rs 2 lakh and Rs 6 lakh, respectively.

While the lower limit of Rs 2.5 lakh is coming with retrospective effect (w.e.f. 15th Feb, 2020), the upper limit has a prospective effect.

The Employees’ Deposit Linked Insurance Scheme (EDLI) is an insurance cover provided by the Employees’ Provident Fund Organization (EPFO). A nominee or legal heir of an active member of EPFO gets a lump sum payment of up to Rs 6 Lakhs (now Rs 7 lakh) in case of death of the member during the service period (active EPF member).

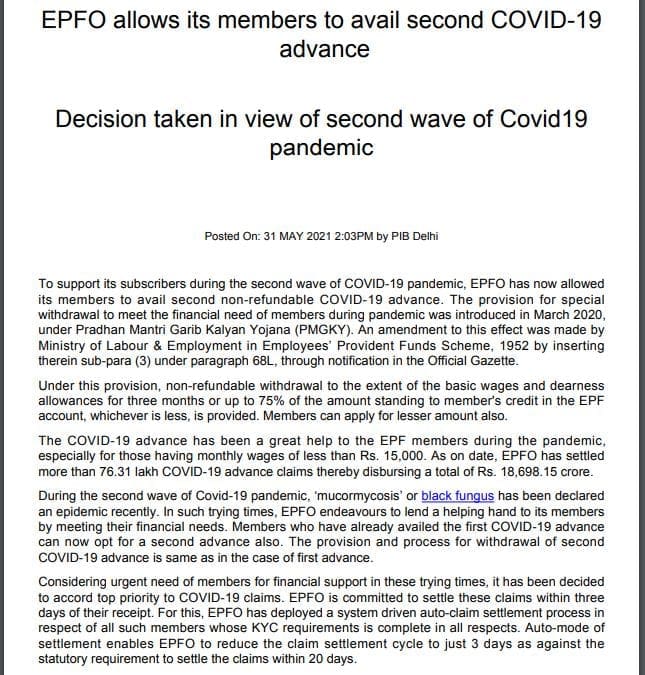

EPFO allows all its members to avail second covid-19 advance (partial withdrawal).

Earlier last year (2020), the EPFO had allowed its members to withdraw COVID-19 advance to meet exigencies due to the pandemic. To support its subscribers during the second wave of COVID-19 pandemic, the EPFO has now allowed its members to avail second non-refundable COVID-19 advance.

The members are allowed to withdraw three months basic wages (basic pay + dearness allowance) or up to 75% of amount standing to their credit in their provident fund account, whichever is less .

The EPFO has settled more than 76.31 lakh COVID-19 advance claims thereby disbursing a total of Rs 18,698.15 crore as on date. If you have already availed the first COVID-19 advance, you can now opt for a second advance also.

Continue reading :

(Post first published on : 31-May-2021)

Sreekanth is the Man behind ReLakhs.com. He is an Independent Certified Financial Planner (CFP), engaged in blogging & property consultancy for the last 13 years through his firm ReLakhs Financial Services . He is not associated with any Financial product / service provider. The main aim of his blog is to "help investors take informed financial decisions." "Please note that the views given in this Blog/Comments Section/Forum are clarifications meant for reference and guidance of the readers to explore further on the topics/queries raised and take informed decisions. The information provided, therefore, should not be viewed as financial, legal, accounting, tax or investment advice."

Abhay Shrivastava says: Is there any sealing of Rs.15000/month salary to be entitled for EPF? Abhay Shrivastava says: Is there any sealing limit of Rs.6000/month irrespective of amount calculated w.r.t Basic+DA? Chandan Prasad Sah says: Sir what’s eligibility to withdraw EPS Sreekanth Reddy says:Dear Chandan,

Below are the options for EPS withdrawals ; If you have worked for less than 10 years and have been unemployed for more than 2 months then you can withdraw entire EPS balance (through Form 10c) along with EPF balance (Form 19).

If you have worked for more than 10 years then you can not withdraw full EPS balance. You can apply for Pension which starts either at 50 (early pension) or 58 years of your age.

In case, you resign from a job and join a new employer who does not offer EPF scheme then you can either withdraw EPS balance (if service history is less than 10 years) or apply for Scheme Certificate from EPFO.

You can submit this certificate when you join an EPF-covered organisation in future. If you do so, your service history gets carried forward.

If you don’t join an organisation and reach 50 or 58 years of age, you can submit these certificates (if employed with multiple employers) to the EPF field office under whose jurisdiction your last employer was covered and apply (Form 10D) for monthly pension.

In case, you resign from your current job and join a new organization where EPF scheme is offered, you can just submit Form-11 form to your new employer. Under this scenario, your EPF and EPS get transferred. You may go through this article : What happens to EPS on Transfer of EPF account (or) when you switch Jobs?

Employee who joins as a fresh PF member on or after 1-Sep-2014 and the basic is above Rs.15000/- he or she cannot opt for EPS scheme. Is there any change in this scheme? If yes can share change please. If no the employee resigns from the present organization and joins another organization where the employee basic is less than Rs.15000/- or restricted PF of Rs.1800/- per month will the employee can become a Pension member?

Sreekanth Reddy says:Dear Chandrasekaran,

There is no change with respect to EPS elgibility criterion.

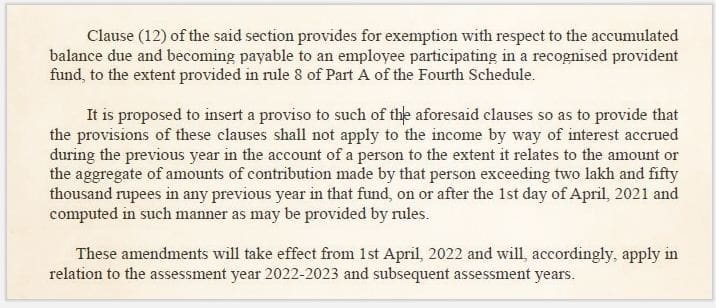

New EPF members enrolled on or after September 1, 2014, and having a salary of more than INR 15,000 month at the time of joining, will not become members of the EPS. Accordingly, the entire contribution of 24% (from the employee and employer) will go to the provident fund account of the employee. I belive – if an employee at the time of joining the EPF scheme had a basic salary exceeding Rs 15,000 per month, then they cannot join the EPS at a later point too. ” So, if your salary is more than ₹15,000 per month, you will have to make an additional voluntary contribution to the EPS to get a higher pension”. 11th july 2023 was the deadline.

Dear Sir,

I have school running. What are criteria for PF registration like number of employees and their salaries. How much PF deduction from Employee salary and Employer Contribution and what are due date of deduction and submission of payment in PF Funds. Kindly guide me please …thanks

Dear Sanjay,

Request you to kindly engage a Chartered Accountant in this regard. Organizations with 20 or more employees are required by law to register for the EPF scheme, while those with fewer than 20 employees can also register voluntarily.

Dear Srikant, Can you please inform me that

1) What are the components on which EPF will be calculate?

2) Basic wages = Minimum Wages or not,

3) Rs 9804 is the current MW for west Bengal then what will be the minimum basic? Samrat Chakraborty